Web3 credit cards are here—and if you’ve been wondering what they actually do (and whether you should care), you’re not alone. In this guide, we’ve got Web3 credit card explained clearly, without the fluff. Just the real perks, drawbacks, and whether this crypto-powered plastic fits into your life.

Pros of Web3 Credit Cards

1. Spend Crypto Like Fiat

Web3 credit cards let you pay with crypto just like you’d use a regular Visa or Mastercard. No complicated exchanges. Tap, swipe, done.

2. Earn Crypto Rewards

Forget airline miles—these cards often reward you in crypto. Think cashback in USDC, ETH, or platform tokens like CRO or NEXO.

3. Bank-Free Access

With some cards, you don’t need a traditional bank account. They connect directly to your custodial or DeFi wallet—more freedom, less friction.

4. Cross-Border Compatibility

Global usage is a breeze. Spend crypto in different countries without the nasty FX rates or bank freezes.

5. DeFi Integration

Some cards double as a gateway to DeFi features like staking, on-chain lending, or borrowing—bringing your crypto portfolio to life.

Cons of Web3 Credit Cards

1. Price Volatility

Paying in crypto means your coffee could cost $3 today and $6 tomorrow if the market swings. That’s not always fun.

2. Tax Complications

In some regions, every crypto transaction—even a $5 purchase—can be a taxable event. (Yes, even that croissant.)

3. Regulatory Hurdles

Depending on where you live, access might be limited. Some cards are geofenced or heavily restricted.

4. Still a Niche Tool

Web3 credit cards aren’t widely accepted by everyone yet. Don’t expect your parents (or your favorite mom-and-pop shop) to be onboard.

5. Fees Can Sneak In

Watch out for hidden conversion fees, monthly charges, or staking requirements that can eat into your gains.

Quick Recap: Web3 Credit Card Explained

What is it, really?

It’s a bridge between crypto and traditional payments. These cards let you use digital assets for everyday spending, often with crypto rewards and Web3 perks baked in.

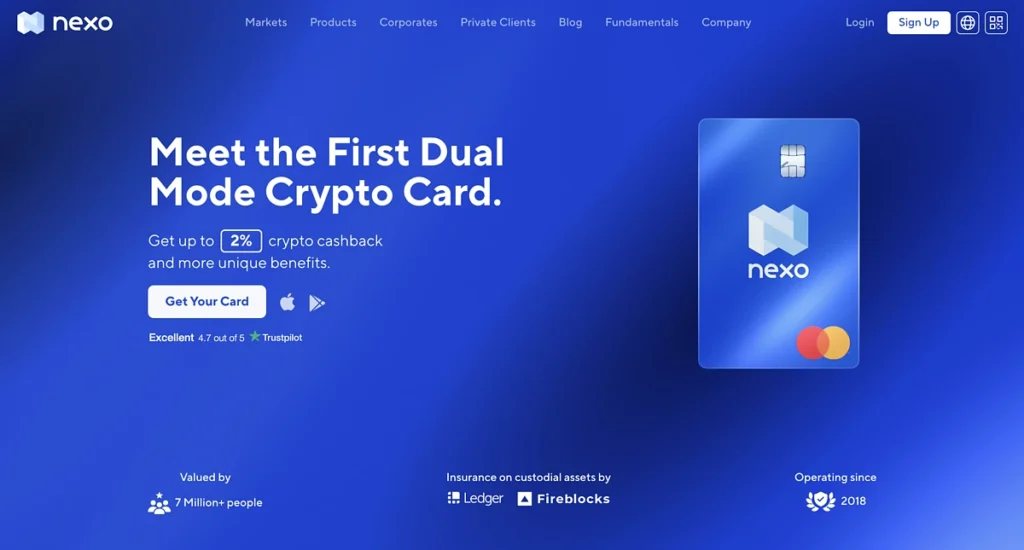

Who’s offering them?

Early adopters include Coinbase, Crypto.com, Nexo, and Hi—all with different models, perks, and requirements.

Final Verdict: Worth It?

Web3 credit cards are exciting—but not for everyone.

They offer new ways to spend, earn, and interact with crypto—but also introduce volatility and complexity. If you’re deep into crypto already, they could streamline your life. If you’re new or cautious? Maybe wait and watch.

One thing’s clear though: if we’re going to make crypto part of daily life, this might be the first swipe that gets us there.

Relevant News : Here