Vietnam’s newly implemented Vietnam Crypto Law 2025 finally gives structure to a market that’s long operated in legal uncertainty. With the VDA rules now enforced, both individuals and companies can participate in the digital asset economy — but must follow specific procedures to remain compliant. This guide walks you through how to get started, from choosing a legal exchange to reporting your gains properly.

Step 1: Understand What VDA Means in Vietnam Crypto Law 2025

Credit from C4S Courses

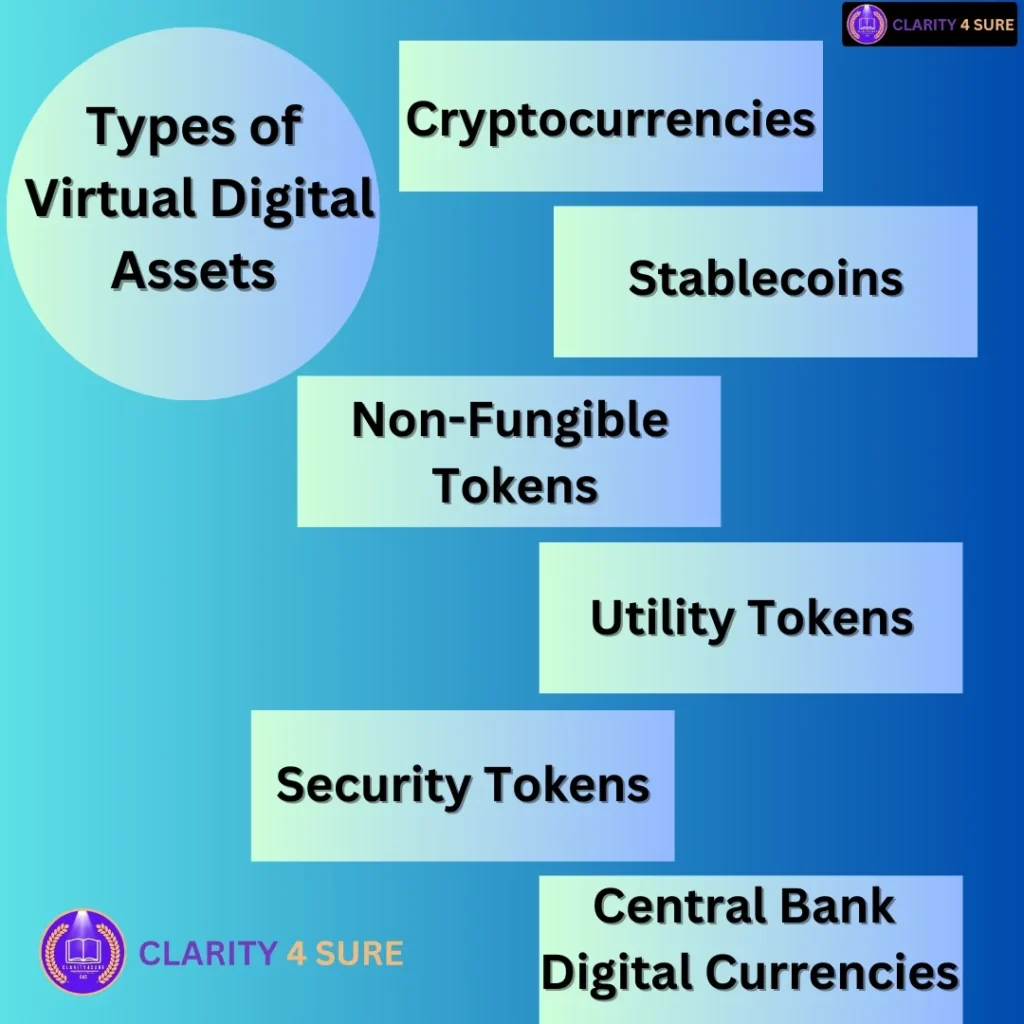

VDA stands for Virtual Digital Asset, and under Vietnam’s current law, this includes cryptocurrencies like Bitcoin, Ethereum, and even NFTs or tokenized stocks. The law divides VDAs into types — including payment tokens, utility tokens, and investment tokens — each with its own requirements. Before you invest or issue any digital asset, it’s important to know how it’s classified, since this determines your legal responsibilities.

For example, a utility token used for access in a gaming platform faces fewer restrictions than a security token tied to profit-sharing. Understanding the type of VDA you’re dealing with is your first step toward legal compliance.

Step 2: Choose a Licensed Exchange

You can only legally buy or sell crypto in Vietnam through government-approved exchanges. These platforms are licensed under the Ministry of Finance and must meet security, anti-money laundering (AML), and data protection standards. Popular international platforms may not be legal unless they have a local presence and registration.

Once you’ve chosen a platform, identity verification (KYC) is required. You’ll need to upload a government-issued ID and go through a screening process before trading. Anonymous wallets are not banned, but any transaction involving a licensed provider must go through verification.

Step 3: Open a Compliant Wallet

Most exchanges offer integrated wallets, but you can also use private options — provided they comply with VDA regulations. While you’re allowed to manage your private keys, any interaction with licensed providers (like exchanges or custodians) must still comply with identity verification and transaction reporting rules.

Hardware wallets are legal and encouraged for security, especially if you hold assets long-term. However, make sure you can document activity if needed for tax or audit purposes.

Step 4: Report and Pay Taxes on Crypto Gains

Credit from AHK Vietnam

One of the key changes under the Vietnam crypto law is taxation. Crypto gains are now treated as taxable income or capital gains. Whether you earn income through trading, staking, mining, or airdrops, the value must be declared.

The General Department of Taxation has released updated guidelines, and most licensed platforms will soon issue annual income summaries for you. If you receive tokens as part of an airdrop or staking reward, the market value at the time of receipt is taxable — and you’ll need to pay additional taxes on any future gains when you sell.

For businesses, crypto transactions must be recorded using fiat equivalents in accounting systems, and reporting is done under corporate tax rules.

Step 5: Avoid Legal Risks of Vietnam Crypto Law 2025

Although crypto is now legal, the VDA rules include strict penalties for violations. Using unlicensed exchanges, promoting unregistered token sales, or failing to declare large crypto holdings can lead to fines or administrative action.

The safest way to stay compliant is to regularly check if your exchange or wallet service is on the Ministry of Finance’s licensed provider list. Also, avoid any schemes or platforms that promise high returns with little transparency — scams are still actively prosecuted under consumer protection and financial fraud laws.

Step 6: Launching a Crypto Startup? Here’s What to Know

Credit from Medium

If you’re a developer or entrepreneur, you’ll need to register your business as a VDA service provider before launching a product that involves crypto. This includes exchanges, DeFi apps, NFT platforms, and token issuers. You’ll need to submit a whitepaper, token model, and show capital reserves, cybersecurity protocols, and risk control mechanisms.

Failure to register could result in your platform being blocked, or worse, criminal charges for unauthorized fundraising or asset distribution.

Final Thoughts of Vietnam Crypto Law 2025: VDA Rules Make Vietnam’s Crypto Market Safer

Vietnam’s shift to a regulated framework in 2025 doesn’t just legalize crypto — it creates guardrails. For users, that means more clarity and fewer risks. For businesses, it offers a legitimate path to innovate and grow.

By following the Vietnam crypto law and understanding how VDA rules apply to your activity, you’re not just staying out of legal trouble — you’re also contributing to a maturing ecosystem that values trust, accountability, and sustainable growth.

Whether you’re trading casually or planning your own blockchain project, this legal clarity is your starting point for long-term success in Vietnam’s crypto future.