Trading Mistakes Beginners Indonesia: Over the past few years, Indonesia has experienced a noticeable surge in trading activity, driven by growing internet access, mobile trading platforms, and the appeal of quick profits from forex and crypto markets. Young investors, especially those in their 20s and 30s, are increasingly drawn to trading as a side hustle or even a primary income source. However, this trading boom has also come with a price—an alarming trend of financial losses among beginners who enter the market without adequate preparation. The increasing number of new accounts being opened doesn’t always reflect success; in fact, it often highlights a parallel rise in poor trading decisions. This phenomenon underscores the importance of understanding trading mistakes beginners Indonesia are consistently making, which can derail their ambitions before they even take off.

Trading Mistakes Beginners Indonesia: Impulsive Entry Without Preparation

Source: JAVA

Many first-time traders in Indonesia are lured by stories of overnight success. This creates a dangerous pattern of jumping into the market with little to no education. They skip demo accounts, disregard market tutorials, and rely on influencer advice or random Telegram signals. The trend indicates a widening gap between interest and actual preparedness. The rush to participate, while understandable in a fast-moving market, often leads to poor decisions, emotional trades, and financial loss. A deeper analysis of beginner behavior shows that this impulsive mindset is driven by FOMO—fear of missing out—which often turns into regret when things go south.

Trading Mistakes Beginners Indonesia: Oversized Positions and Unrealistic Expectations

Source: UX Psychology

A recurring trend in the behavior of beginner traders is the overestimation of their capabilities and the market’s predictability. New traders in Indonesia are increasingly depositing large amounts of capital into accounts and risking high percentages on a single trade. Their expectations are heavily influenced by online content showing screenshots of huge profits. The problem is that these visuals rarely show the full story—especially the risks taken or the losses endured. As a result, beginners take unnecessary risks without understanding the concept of capital preservation. Many expect to double their money in weeks, only to end up wiping out their account in days. This unrealistic mindset is becoming a significant issue in the local trading ecosystem.

Trading Mistakes Beginners Indonesia: The Decline of Risk Management Practices

Despite widespread information about risk management, many Indonesian beginners still trade without using stop-loss orders or proper position sizing. This lack of discipline shows a dangerous trend: traders betting their entire capital on single positions, often on highly volatile assets like crypto. The excitement of a potential big win outweighs rational planning. Unfortunately, this “all-in” mentality doesn’t align with the nature of sustainable trading. Seasoned professionals emphasize that managing risk is what allows them to survive long-term, yet this lesson is often ignored until it’s too late. Without risk controls, even a single bad trade can end a beginner’s journey permanently.

Rise of Emotional and Revenge Trading

Source: Equiti

A growing number of Indonesian traders report feelings of stress, frustration, and regret shortly after their first trading losses. This emotional turbulence leads many to engage in revenge trading—placing random trades in an attempt to recover losses quickly. Emotional trading is not new, but what’s alarming is the frequency with which beginners experience these breakdowns. Many aren’t equipped to handle the psychological demands of the market. They fall into negative spirals, making decision after decision based on panic or ego. This trend reflects a broader need for psychological education alongside technical training in trading circles across Indonesia.

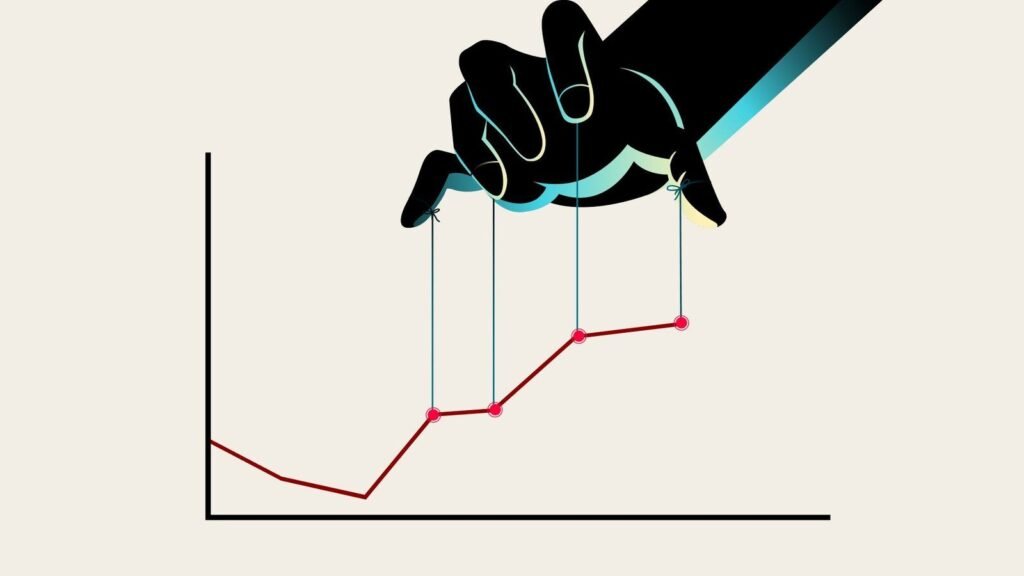

Overreliance on Social Media “Experts”

Source: Obiex

Another worrying trend is the dependency on unverified influencers and trading groups. Social media platforms are flooded with self-proclaimed experts offering “guaranteed” signals and premium mentorships. For many beginners, especially in Indonesia where online communities are active and persuasive, this creates a false sense of security. Instead of learning to analyze charts or understand macroeconomic factors, new traders often blindly follow others. When trades go wrong, they lack the knowledge to understand why—leaving them disillusioned. This copy-trading culture is undermining critical thinking and encouraging herd mentality over self-reliance.

Misjudging Crypto Volatility

Source: MacroMicro

As crypto trading continues to gain popularity in Indonesia, many beginners are jumping into highly volatile coins without understanding their dynamics. Driven by TikTok trends or viral tweets, traders often buy coins at peak prices, hoping to ride the wave up. However, without knowledge of market cycles, liquidity, or token fundamentals, many suffer heavy losses during sudden crashes. The trend shows that beginners treat crypto like a lottery rather than a market. While the potential for high returns exists, the lack of fundamental analysis and exit strategy among new Indonesian traders is a red flag that must be addressed through education and better awareness.

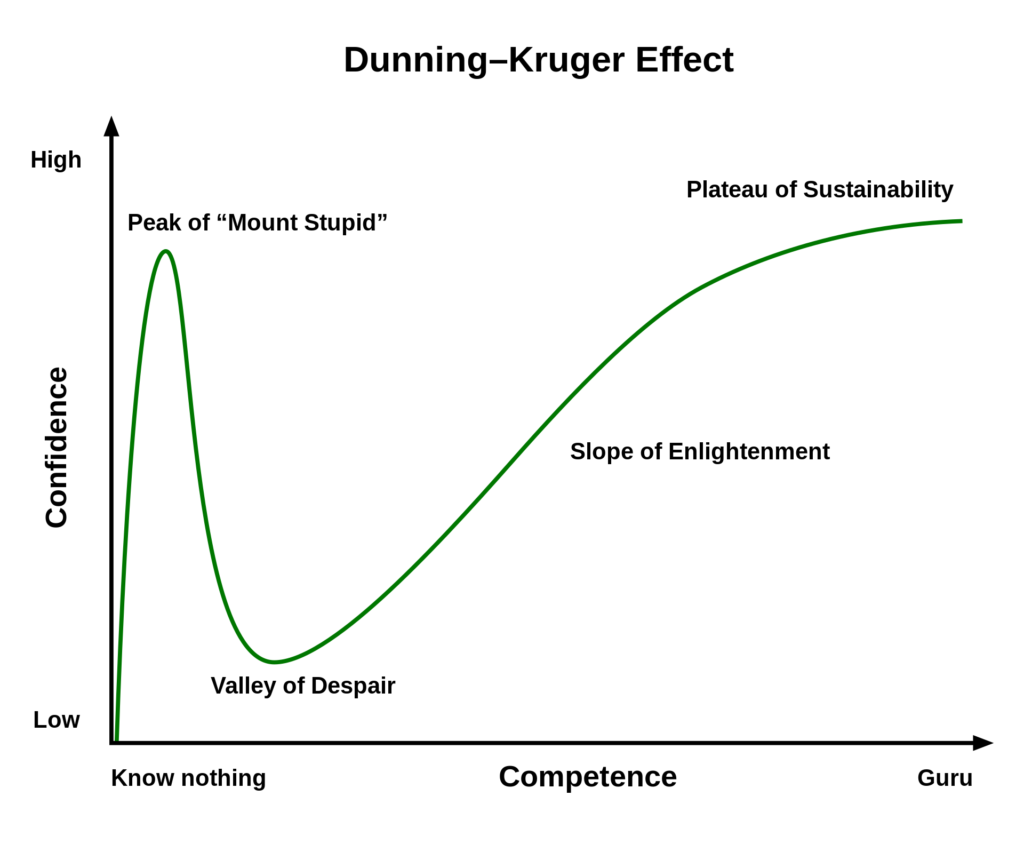

Lack of Continuous Learning Culture

Perhaps the most concerning trend is the perception that trading is a “get-rich-quick” scheme rather than a long-term skill. Once they learn a few indicators or trading terms, many beginners stop studying and fall into repetitive patterns of losses. Unlike more developed trading communities where knowledge-sharing and continuous education are normalized, Indonesian beginner traders often lack mentorship, feedback systems, and structured learning paths. Without ongoing development, their skills plateau, and mistakes compound. This stagnation ultimately leads to burnout and account abandonment, a cycle that could be broken with the right support and mindset shift.

Conclusion: Learning from the Trend Before It’s Too Late

The trading trend in Indonesia is only expected to grow, bringing more newcomers into the market each day. But along with this growth comes responsibility—to ensure that beginners are equipped not just with excitement, but also with knowledge, discipline, and the right mindset. By analyzing and understanding the common trading mistakes beginners Indonesia face, we can create awareness and promote a healthier trading environment. Encouraging responsible trading, building educational communities, and promoting emotional discipline will not only protect beginners but also strengthen the overall trading culture in the country.