Thailand’s Crypto Tax Landscape in 2025: Are Traders Catching Up with the Rules?

Over the past few years, Thailand has worked hard to clarify its stance on digital assets. And while the tax on crypto in Thailand isn’t exactly new, 2025 has marked a noticeable shift—not necessarily in the laws themselves, but in how they’re being understood, enforced, and followed by traders.

The question isn’t just “Is there tax on crypto?” anymore. It’s turning into “Are people actually paying it?” And what’s more interesting—why are some finally starting to?

Let’s take a look at how the landscape has changed, what patterns are emerging, and where this trend might go next.

From Law to Reality: The Gap Is Closing

Since 2022, Thailand has recognized crypto earnings as taxable income. That includes capital gains, staking rewards, mining profits, NFT sales—even airdrops if they hold value.

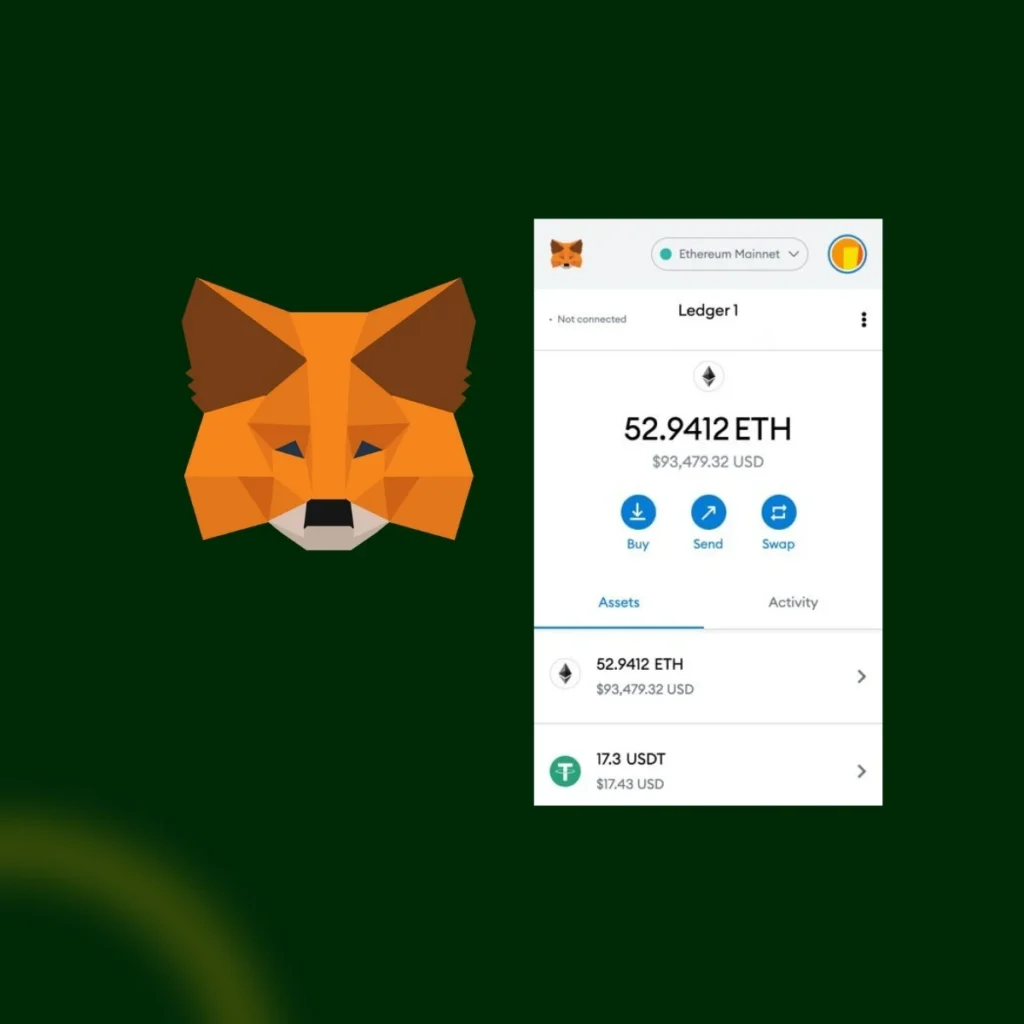

But enforcement? That’s been another story. For a while, there was a wide gap between what the law said and what was happening in the wild. Traders on Thai Telegram groups often joked that “nobody actually files,” especially if they stuck to wallets like MetaMask or dealt in offshore exchanges.

In 2025, that narrative is starting to change. Quietly, but noticeably.

Credit from : Prospectree

Tax on Crypto in Thailand: What’s Driving the Shift in Behavior?

One key trend this year is the growing cooperation between local crypto platforms and the Revenue Department. Licensed exchanges like Bitkub and Binance TH are now expected to provide transaction reports when requested.

Combine that with increasingly watchful banks flagging large or suspicious crypto inflows—and suddenly, it’s not so easy to assume your trades are invisible.

It’s not just about enforcement. Thai traders themselves seem more informed this year. With more articles, TikToks, and even accountants chiming in, the average crypto investor is starting to realize that tax avoidance may not be worth the risk long-term.

Tax on Crypto in Thailand: The Growing Complexity of What’s Considered “Taxable”

Another trend in 2025? Confusion. The list of taxable crypto activities keeps growing—but the rules remain gray in some areas.

Yes, it’s clear that selling Bitcoin for a profit is taxable. But what about token swaps? NFT royalties? Staking via a decentralized platform? These aren’t always explicitly addressed in Thai tax forms, leaving many traders wondering whether they need to report every little interaction.

This legal ambiguity is driving more people to seek professional help—and in turn, raising awareness of what could trigger a tax obligation.

Credit from : PBS

Exemptions Are Helping—but Not That Much

To be fair, Thailand has offered a few incentives to make things easier. Gains from trading on registered Thai exchanges are often exempt from the 15% withholding tax, for example. But that doesn’t let you off the hook for personal income tax—just one layer of the stack.

Some savvy traders have tried going the corporate route, registering companies to manage crypto portfolios with more flexibility. But for the average retail investor, these workarounds are too complex or too costly to justify.

So while the government is trying to encourage compliance, the real trend suggests that most Thai traders are just now catching up to the basic expectations—like declaring their yearly profits.

A New Mindset Is Emerging Among Thai Crypto Traders

Perhaps the most important shift in 2025 is psychological. Crypto in Thailand has moved from a fringe interest to a mainstream financial tool. As a result, traders are starting to see tax reporting not as an annoying afterthought—but as a necessary part of staying legit.

There’s also a generational shift happening. Younger Thai investors, especially those with traditional finance experience or entrepreneurial backgrounds, seem more open to the idea of declaring gains—especially if they’re planning to apply for loans, visas, or anything requiring financial documentation.

Crypto isn’t a side hustle anymore. For many, it’s a real income stream. And that means treating it with a bit more caution.

Where’s This All Going?

So what’s next?

Regulators are gearing up. Thai banks are getting smarter. And the global crypto reporting landscape is evolving quickly—especially with frameworks like the OECD’s Crypto-Asset Reporting Framework gaining traction.

All signs point to tighter control, not looser. While 2025 hasn’t brought sweeping new tax laws, it has brought a clear uptick in monitoring and education. The cat’s out of the bag, and pretending the system doesn’t exist won’t work much longer.

For now, Thailand’s crypto traders sit in a strange in-between space—more informed than before, still cautious, but gradually moving toward compliance. Slowly, the culture of “hide and hope” is giving way to a new trend: “get it sorted before it’s a problem.”