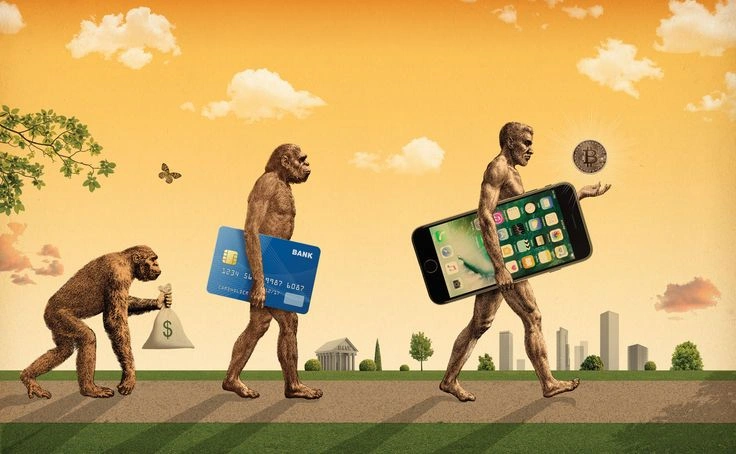

Web3 spending behavior: Imagine a world where your paycheck isn’t deposited into a bank, but lands in your crypto wallet—maybe as ETH, maybe as a token tied to a DAO. What if saving meant staking, and your emergency fund wasn’t cash, but an NFT you could borrow against?

That’s not science fiction—it’s Web3. And it’s already changing how people think about money.

What If Getting Paid Didn’t Mean Dollars in Your Bank Account?

In Web2, you get paid, you spend, you (hopefully) save. That’s been the cycle for decades. But what if payment came in volatile tokens instead of stable fiat?

That’s the reality for freelancers and contributors in Web3. They might earn governance tokens, stablecoins, or NFT royalties—but income swings with the market. One week’s pay might be enough to cover bills; next week it might drop 30% in value.

Suddenly, budgeting becomes forecasting token volatility. And financial planning? It’s a live market dashboard.

What If Living Paycheck-to-Paycheck Meant Living Block-to-Block?

What if every bill you paid depended on the blockchain confirming your payout? For many in Web3—especially builders, artists, and DAO contributors—that’s already true.

They operate in a crypto-flavored version of paycheck-to-paycheck living. Instead of waiting for an employer’s direct deposit, they’re waiting for DAO votes, bounty releases, or NFT sales. And don’t forget gas fees—because sometimes sending your “paycheck” can cost you $50 in transaction fees.

It’s freedom, yes—but fragile freedom.

Web3 spending behavior: What If You Could Live Off Your Digital Assets Instead?

Now flip the script. What if you didn’t need a paycheck? What if your assets—staked tokens, blue-chip NFTs, LP positions—worked for you?

Some Web3 natives are already doing this. They’re not waiting to get paid; they’re farming yield, accessing gated perks, and leveraging assets for loans.

Imagine your favorite NFT granting you access to premium tools, real-world events, or even airdrops worth more than your last gig. That’s not fantasy—it’s part of the new financial toolkit.

Web3 spending behavior: What If Financial Identity Was No Longer Just Income-Based?

In traditional finance, income is king. But what if, in Web3, your net worth wasn’t just how much you earn—but how well you deploy your assets?

Some people treat tokens like cash—spend it and move on. Others treat them like equity—hold, speculate, stake. This isn’t just about wealth—it’s about philosophy.

What if your financial identity was shaped less by a monthly paycheck and more by how you use decentralized tools?

What If You’re in Web3… But Still Stuck in Web2 Mindsets?

Here’s a more personal what-if: What if you’re already in Web3—but still thinking like it’s Web2?

Maybe you’re chasing fast flips without building stable systems. Maybe you’re sitting on assets you don’t know how to leverage. Maybe volatility keeps you stuck in survival mode.

What if a better future was less about luck—and more about learning how to make your assets work?

Web3 spending behavior: So… What If the Future of Money Is Already Here?

Web3 is redefining money. It’s not just how much you have, but how you have it—tokens, NFTs, staking positions, DAO shares. That changes everything about how people spend, save, and survive.

Sure, some will always live gig-to-gig. But others are already crafting decentralized financial systems that go beyond the paycheck.

What if you could do both? Get paid in stablecoins, invest in volatile tokens, use NFTs for access, and stake for yield. That hybrid model may be the real future—and the real freedom.

So don’t just ask how much you earn.

Ask: What if you could earn smarter? What if your assets could give you options?

Because in Web3, that’s not a dream—it’s a choice.

Relevant News: Here