Step 1: Start with the Big Picture — What Is the Rupiah Forecast 2025?

The Rupiah Forecast 2025 is a forward-looking view of how Indonesia’s currency, the IDR, may perform throughout the year, particularly against major currencies like the U.S. dollar. It’s not a one-size-fits-all number, but rather a reflection of multiple moving parts: domestic economic performance, trade flows, investor confidence, and the broader global market. This year, forecasts are especially cautious. While Indonesia’s fundamentals remain relatively stable, the world economy is shifting — and with it, capital flows and exchange rate dynamics. Understanding this forecast means watching how global uncertainty interacts with local strength — and how both shape the trajectory of the IDR.

Step 2: Watch What’s Driving Global Currency Pressure

Source: Moderndiplomacy

To interpret any Rupiah forecast 2025, you have to consider what’s happening globally. A major factor is U.S. monetary policy. If the Federal Reserve holds interest rates higher for longer, the dollar tends to strengthen, which often pulls the Rupiah downward. On top of that, global risk sentiment is still uneven. Investors continue to respond cautiously to geopolitical instability, global supply chain shifts, and slower growth in China and Europe — all of which can push capital out of emerging markets. In short, when the global environment tightens, risk-averse investors often retreat to the U.S. dollar, and currencies like the IDR can get caught in the crossfire.

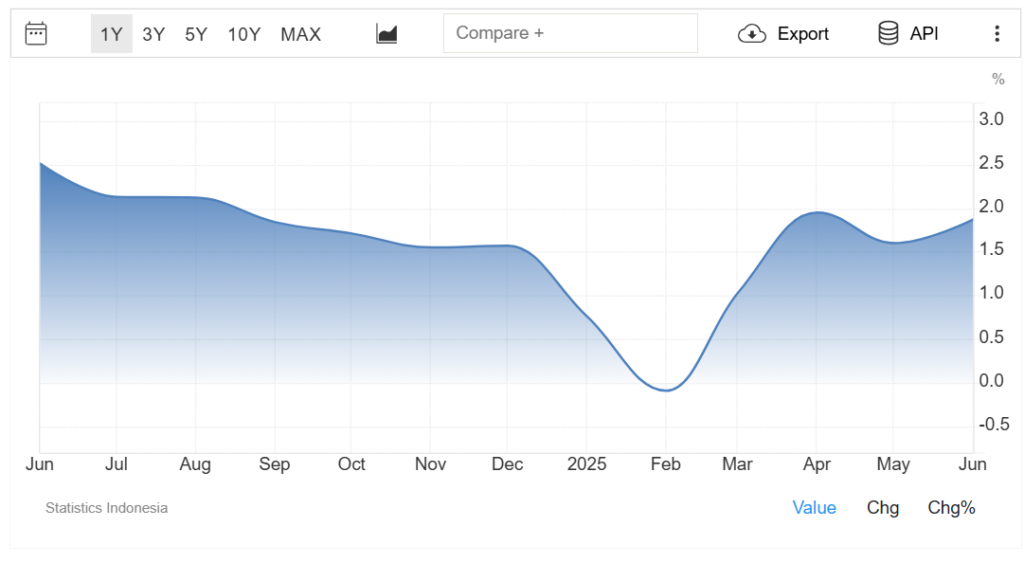

Step 3: Rupiah Forecast 2025- Understand How Domestic Indicators Shape the IDR

Source: TradingEconomics

While external forces dominate headlines, Indonesia’s internal economy is equally critical in shaping the Rupiah forecast. Indicators such as inflation, GDP growth, fiscal spending, and the current account balance all feed into investor confidence in the IDR. For 2025, Bank Indonesia’s inflation-targeting framework has helped provide a degree of price stability. At the same time, Indonesia’s trade surplus — especially in key exports like palm oil, coal, and nickel — continues to support foreign exchange inflows. The central government’s commitment to infrastructure investment is also seen as a positive signal. Still, policy missteps or fiscal slippage could shake confidence quickly. The strength of the Rupiah depends not just on data, but on the policy credibility behind it.

Step 4: Rupiah Forecast 2025- Track Bank Indonesia’s Actions Closely

Source: Bloomberg

Any serious look at the Rupiah forecast 2025 requires paying close attention to Bank Indonesia, which manages monetary policy and defends the IDR in times of volatility. In recent years, the central bank has taken a careful approach — intervening in foreign exchange markets when needed, while maintaining real interest rates to attract capital. For this year, its moves will likely remain cautious but responsive. Analysts will be watching how the bank balances inflation control with currency stability. Subtle signals from press briefings, rate decisions, and foreign reserve updates often tell more than headline policy changes. Market reactions to Bank Indonesia’s tone and timing can move the IDR almost as much as the decisions themselves.

Step 5: Compare the Rupiah With Other EM Currencies

Looking at the broader emerging market currencies outlook 2025 helps place the Rupiah in context. While it’s not the most volatile EM currency, the IDR remains susceptible to shifts in global liquidity and investor mood. Compared to countries with large fiscal deficits or political uncertainty, Indonesia appears more stable — but the IDR is still grouped into regional or asset-class baskets by global investors. If emerging markets fall out of favor, even fundamentally strong currencies like the Rupiah may come under pressure. This is why relative performance matters. When tracking the forecast, always ask: is the IDR falling because of local weakness — or is it simply being pulled along by broader EM trends?

Step 6: Recognize Key Risks to the IDR in 2025

Understanding risk scenarios is essential to reading any Rupiah forecast effectively. The most immediate risks in 2025 include persistently high global interest rates, weaker commodity prices, and declining trade demand from China. A stronger U.S. dollar and renewed global risk aversion could also trigger capital outflows. Locally, concerns include possible policy uncertainty in the lead-up to political transitions or a spike in inflation due to food or fuel costs. None of these risks are guaranteed to materialize, but they form the “what if” scenarios that markets are constantly pricing in. Staying aware of these moving parts can help you prepare for both expected and unexpected shifts in the IDR’s value.

Step 7: Use the Forecast to Shape Your Financial Planning

Finally, the practical takeaway from the Rupiah forecast 2025 is how it can inform decision-making. For businesses, it helps shape procurement planning, pricing strategies, and import/export margins. For investors, the forecast is a tool for timing positions in IDR-denominated bonds, stocks, or FX markets. For individuals, it might influence how and when to travel, save, or convert currency. The key is not to treat forecasts as guarantees — but to use them as a framework. By staying updated on the key forces driving the IDR, you can adapt your decisions to changing conditions, not react to them after the fact.