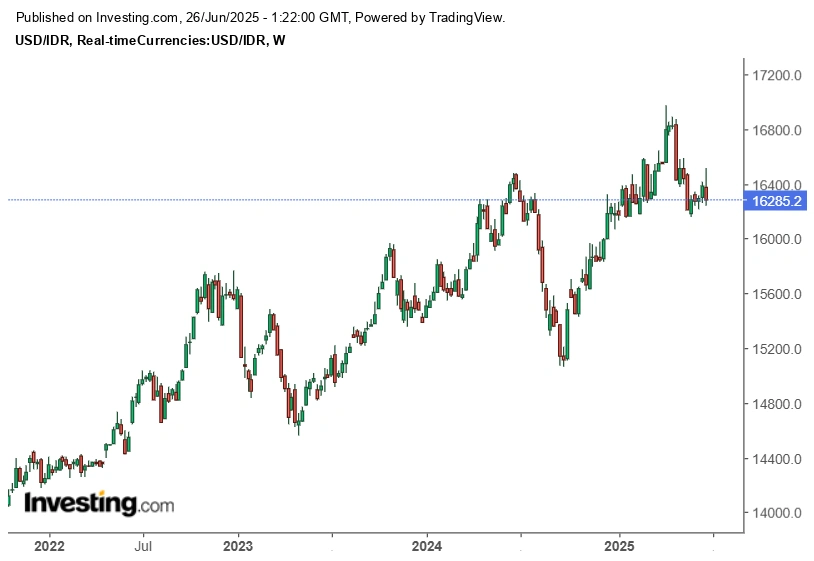

Currency swings aren’t just background noise anymore — especially if you’ve been watching the Indonesian rupiah struggle. Whether you’re planning long-term savings or just don’t want your money to quietly lose value, it’s no surprise that more people are looking into the gold hedge rupiah approach.

But how do you actually do it? Is gold really a smart move in 2025? Here’s a beginner-friendly, realistic guide to getting started with gold as a currency hedge — no fancy jargon needed.

Step 1: Understand the Gold-Rupiah Connection

Source: Investing.com

Here’s the short version: gold is priced globally in US dollars. So when the rupiah weakens against the dollar, the price of gold in IDR goes up — even if the price of gold stays flat in USD. That’s the whole idea behind the gold hedge rupiah strategy. It’s a way to keep your money from shrinking in value when the rupiah falls.

It’s not about turning into a gold investor overnight. It’s about staying one step ahead of currency risk.

Step 2: Gold hedge rupiah- Spot the Right Time to Hedge

Source: TradingView

You don’t need to wait for a crisis. In fact, hedging works best before things get bumpy. Here are a few signs it might be time to consider gold:

- The rupiah is weakening steadily

- Inflation is pushing up daily costs

- The global economy feels unstable (U.S. rate hikes, oil shocks, or regional tension)

- Your long-term savings are all in IDR

If two or more of those hit home? It’s probably worth adding gold to your toolkit.

Step 3: Gold hedge rupiah- Choose the Format That Fits You Best

There’s no single “right” way to buy gold. What matters is choosing one that makes sense for your goals, budget, and comfort level:

- Physical gold — Classic bars or coins from trusted sources like Antam or Pegadaian. Safe, but needs storage.

- Digital gold — Buy and sell small amounts using apps like Tokopedia Emas, Lakuemas, or Pluang. Easy and convenient.

- Gold-backed funds (ETFs) — Ideal for investors who already use brokerage platforms.

Even starting with just 1 or 2 grams is enough to get going. The key is to begin — not to be perfect.

Step 4: Keep Your Costs in Check

It’s easy to get excited and forget about fees — but they eat into your hedge. Before you buy:

- Compare buy/sell spreads

- Check for storage or platform fees

- Watch out for minimum redemption charges

The fewer fees you pay, the more effective your gold hedge rupiah strategy becomes.

Step 5: Don’t Go All In — Balance Is Key

Gold isn’t a get-rich tool. It doesn’t pay dividends. It’s not meant to replace your savings account or investments. Think of it like a safety net. A common recommendation? Keep 5–15% of your portfolio in gold, just enough to absorb shocks — not enough to limit your financial flexibility.

Step 6: Monitor Trends, Not Hourly Charts

Don’t get obsessed with watching gold prices every hour. That’s trader behavior, not hedger thinking. Instead, check the bigger picture monthly:

- Is the rupiah still losing ground?

- Any major inflation updates?

- Are global gold prices rising?

If nothing’s changed, your hedge can stay put. If stability returns, you can rebalance — sell a little, reinvest elsewhere.

Step 7: Revisit and Adjust When Needed

The economy doesn’t stay the same forever. Maybe the rupiah recovers. Maybe another asset becomes more attractive. Either way, gold hedging isn’t a forever plan — it’s a flexible move. Keep reviewing your position every few months and adjust based on what’s happening.

Final Thoughts

Building a gold hedge rupiah strategy isn’t complicated — but it does take a little thought. In 2025, as economic uncertainty continues, gold remains a useful tool to help Indonesians hold on to what they’ve worked hard to save.

It’s not flashy. It won’t double overnight. But it just might help you sleep better — and in times like these, that’s worth its weight in gold.