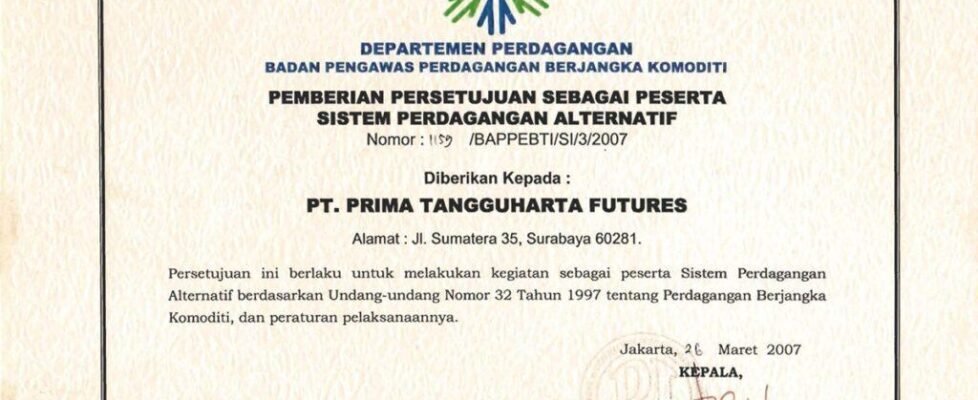

Forex regulation Indonesia: In Indonesia, forex trading is permitted — but not without structure. As of 2025, the legal landscape is governed by two main bodies: Bappebti (the Commodity Futures Trading Regulatory Agency) and OJK (Financial Services Authority).

These regulators don’t just oversee brokers — they define who can operate, how they advertise, and how trading services are delivered to the public. So while trading itself isn’t banned, it’s only considered legal when done through brokers registered with Bappebti.

This legal structure is meant to prevent market abuse, protect retail investors, and establish transparency.

Forex regulation Indonesia: Know Which Brokers Are Approved

Source: VRITIMES

Before choosing any forex platform, it’s important to check whether the broker is authorized to operate in Indonesia. Bappebti maintains a public list of licensed brokers — and that list is the only one that matters.

Many online platforms appear polished and user-friendly, but if they aren’t on Bappebti’s list, they’re considered illegal under Indonesian law. These brokers may operate overseas and offer tempting promotions, but they lack local oversight and legal accountability.

If you want full protection while trading, always use a broker that has been legally certified by the Indonesian government.

Forex regulation Indonesia: Understand What Makes a Broker Legal in 2025

The forex regulation Indonesia enforces requires brokers to meet several specific criteria before they can serve the local market. These include having physical offices in Indonesia, offering services in Bahasa Indonesia, maintaining financial reserves, and undergoing regular audits.

Brokers must also limit their marketing to realistic, educational content. They can’t promise profits or advertise forex as an easy income stream. Risk disclosures and clear contract terms are mandatory.

These requirements help separate legitimate trading services from the kinds of operations that leave investors vulnerable to fraud or manipulation.

Forex regulation Indonesia: Stay Clear of Unregulated Foreign Platforms

Just because a platform is accessible from your browser or app store doesn’t mean it’s legal. In fact, many international brokers continue to serve Indonesian clients without proper authorization.

These brokers are often blocked by the government, but some still bypass restrictions using mirror sites or third-party apps. Using them may seem harmless — until you run into issues like delayed withdrawals, unfair slippage, or account restrictions.

The government can’t intervene in these situations because your trading activity is outside Indonesia’s legal reach. That’s why local compliance matters, even if foreign brokers offer better features or higher leverage.

Learn What You’re Allowed to Do as a Trader

As a retail trader, you’re legally allowed to open an account, deposit funds, and place trades — as long as the broker you use is licensed under Indonesian law. This applies whether you’re trading from your smartphone or computer.

However, your access to tools like leverage, margin, and product types may be more limited compared to foreign platforms. These limitations are by design — they’re intended to manage risk and prevent novice traders from making oversized bets with borrowed funds.

Legal trading isn’t restrictive — it’s structured to give you the tools without exposing you to unnecessary losses.

Use Government Tools to Stay Informed

Source: okezone

Bappebti actively monitors the forex space in Indonesia. They regularly update their list of licensed brokers, publish warnings about blacklisted websites, and collaborate with the Ministry of Communication and Information (Kominfo) to block non-compliant platforms.

As of 2025, more than a thousand illegal trading sites have been taken down. Social media channels, forums, and affiliate networks are also being watched closely. This isn’t just about punishment — it’s about protecting the public from schemes that often appear legitimate on the surface.

You can visit Bappebti’s site directly or follow their alerts through local financial news platforms to stay up to date.

Why Compliance Brings Peace of Mind

Source: FXNEWSGROUP

When you trade through a licensed broker, you’re not just following the rules — you’re gaining peace of mind. These brokers are required to safeguard client funds, provide real-time market data, and resolve disputes through legal channels.

You also avoid the risk of sudden account bans, withdrawal freezes, or legal issues that could arise from trading on blacklisted platforms. In a volatile market like forex, knowing that your broker is accountable under local law can make a major difference.

The forex regulation Indonesia puts in place is designed to make that peace of mind possible — without sacrificing market access.

Conclusion: Legal Doesn’t Mean Complicated

Forex trading in Indonesia is legal, accessible, and increasingly popular. But that doesn’t mean you can skip the rules. The forex regulation Indonesia enforces in 2025 provides a framework where traders can operate safely — as long as they stick with licensed platforms and stay informed.

The smartest traders aren’t just looking for the highest return — they’re also checking the broker’s legal standing, platform reliability, and government compliance. Legal trading isn’t complicated. It’s just responsible.