Currency services in Indonesia are evolving fast — from familiar money changers in shopping malls to digital forex trading apps accessible from your smartphone. For many people, the phrase Forex Indonesia now refers to both the traditional and the modern ways of dealing with foreign currencies. However, these services aren’t the same. Whether you’re looking to trade online or exchange money for a trip abroad, understanding the key differences is essential. This guide will help you learn the basics and make the right choice based on your goals.

What Is Forex Trading?

Forex trading, short for “foreign exchange trading,” is the act of buying and selling currency pairs to profit from changes in exchange rates. For example, if you believe the US dollar will rise against the Indonesian rupiah, you might buy USD/IDR and then sell it later at a higher rate. This is all done online, through platforms or apps provided by forex brokers.

In Indonesia, forex trading is becoming increasingly popular — especially among younger, tech-savvy users looking for new investment channels. To trade legally, you must register with a broker licensed by BAPPEBTI, the government agency that regulates commodity and forex trading. Forex trading platforms provide real-time price charts, analysis tools, and leverage — meaning traders can control larger positions with less capital. But this also increases the risk of losses. In the Forex Indonesia ecosystem, trading is seen as a high-risk, high-reward financial activity that requires planning and discipline.

What Is a Money Changer?

Source: govaluta

Money changers are licensed businesses that convert physical cash from one currency into another. You can walk into a money changer with Indonesian rupiah and walk out with US dollars, euros, yen, or any currency they support. These services are ideal for travelers, overseas students, or businesses that need to settle foreign payments in cash.

The process is fast and straightforward. You view the exchange rate, hand over your money, and receive a printed receipt along with your converted cash. In Indonesia, all licensed money changers operate under the regulation of Bank Indonesia. This means they must follow official guidelines on pricing, transparency, and transaction documentation. Within the Forex Indonesia framework, money changers represent the offline, real-world side of currency services that people rely on daily.

The Main Differences Between the Two

Source: t4trade

Though both services deal with foreign currency, forex trading and money changing have distinct differences in how they operate and who they serve.

Forex trading is digital and speculative. You never touch the physical money — instead, you profit (or lose) based on price movements in the global forex market. The service is designed for those who are interested in financial markets and have time to monitor the charts and economic news.

Money changers, by contrast, offer face-to-face service and real cash. There’s no speculation or trading involved. You exchange a fixed amount at a posted rate, usually for a specific purpose like travel or business.

In short, forex trading is about potential income and market participation. Money changing is about immediate utility and access to usable cash. Both are valid — just for different needs in the broader Forex Indonesia ecosystem.

When Should You Choose a Money Changer?

Source: The Jakarta Post

If you’re heading abroad or need to pay for something in foreign currency, a money changer is the practical solution. You don’t need any special knowledge or tools — just walk into a licensed outlet, show your ID, and exchange your money. The process takes just a few minutes.

This option is especially suitable for people who prefer traditional transactions, aren’t comfortable using financial apps, or simply want fast, clear service. Whether you’re a tourist, student, or small business owner, money changers are still an essential part of daily financial life in Indonesia.

When Does Forex Trading Make Sense?

Forex trading is ideal if you’re interested in market dynamics and willing to invest time in learning how currency prices move. It’s more than just pressing “buy” or “sell” — it requires analysis, practice, and emotional control. Many beginners start with demo accounts to get a feel for the platform before investing real money.

The key is to treat trading as a long-term skill, not a get-rich-quick scheme. Losses are part of the journey, and successful traders focus on strategy and risk management. If you’re serious about investing and curious about the global economy, forex trading could be a meaningful addition to your financial toolkit — especially with the right education and a BAPPEBTI-approved broker.

Forex Indonesia : What About Exchange Rates?

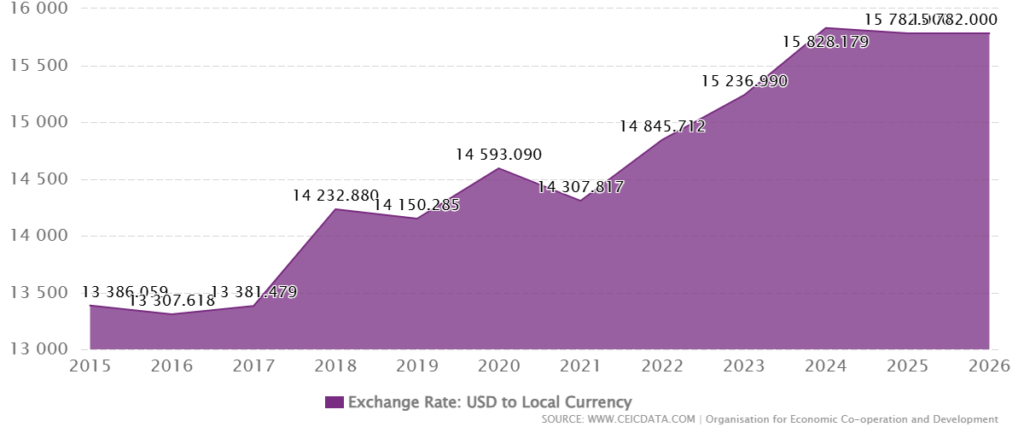

Source: ceicdata

Exchange rates work differently in trading and money exchange services. At a money changer, the rate you get includes a service margin — which is how they earn a profit. These rates may vary slightly across different locations, especially between malls, airports, and city centers.

In forex trading, the rates are dynamic and based on global interbank pricing. The prices update by the second, and brokers typically charge a small spread or commission. While these rates are often tighter than those at money changers, they also come with volatility — and your profit or loss depends entirely on timing. Both have their advantages depending on whether you need certainty or are open to risk.

Forex Indonesia: How to Use These Services Safely in Indonesia

Source: Antara News

Using currency services legally and safely in Indonesia is straightforward, as long as you work with registered providers. For forex trading, always check whether the broker is registered with BAPPEBTI. The official list is available online, and only licensed platforms should be trusted with your funds.

For money changers, make sure the outlet is certified by Bank Indonesia. Legal money changers display licenses clearly and provide printed receipts for all transactions. Avoid exchanging money on the street or using apps that aren’t registered — even if the rate looks good. Staying within regulated channels protects both your money and your identity.

Conclusion: Forex Indonesia- Two Different Tools for Two Different Needs

Both forex trading and money exchange have their place in today’s financial world. Whether you’re trying to invest or simply preparing for a trip, knowing which service to use — and how it works — can save you time, money, and stress.

The term Forex Indonesia now represents a broader landscape than ever before. It includes risk-tolerant traders, everyday consumers, and everything in between. Understanding the differences between trading and money exchange helps you take full advantage of the services available — safely and wisely.