If you’re planning to start trading Forex in Thailand in 2025, the first big decision you’ll face is which platform to use. With dozens of brokers available—some global giants, some newer names—it can be tough to know where to begin.

This guide will help you make that decision step by step. Whether you’re completely new or looking to switch brokers, here’s how to find a platform that actually works for you.

Step 1: Know What You Need as a Trader of Forex in Thailand

Before you dive into comparisons, get clear on a few personal factors:

- Are you a beginner or experienced?

- Do you need Thai-language support?

- Will you trade on mobile or desktop?

- Do you prefer fixed or floating spreads?

- How much are you planning to deposit?

Understanding these basics will save you from wasting time on platforms that don’t match your style.

Credit from : Orienta Vista

Step 2: Focus on Regulated and Trusted Brokers When Entry Forex in Thailand

Always start with brokers that are licensed by reputable authorities. Many traders in Thailand use international brokers with licenses from ASIC (Australia), CySEC (Cyprus), or FCA (UK).

Here are five platforms that have solid reputations and offer strong features for Thai users.

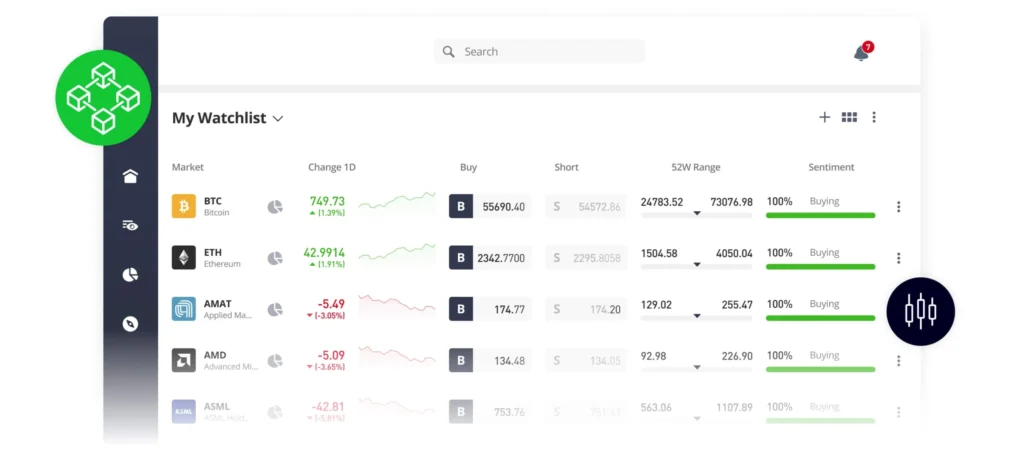

Step 3: Compare the Top 5 Platforms for Forex in Thailand

1. Exness – Simple and Local-Friendly of Forex in Thailand

- Why choose it: Fully supports Thai language, offers local banking options (SCB, Krungthai), and has a very user-friendly interface.

- Who it’s for: Beginners or casual traders who want ease of use and local integration.

- Watch out for: Limited advanced tools for high-volume or algorithmic trading.

2. IC Markets – Designed for Low Spreads and Fast Execution

- Why choose it: Offers raw spread accounts (starting from 0.0 pips) and fast execution ideal for scalpers.

- Who it’s for: Experienced traders focused on costs and performance.

- Watch out for: No Thai baht accounts and minimal Thai-language support.

3. XM – Bonus Offers and Flexible Accounts

- Why choose it: Offers micro and standard accounts, plus a no-deposit bonus for new Thai users. Also strong on educational content.

- Who it’s for: New traders or intermediate users who want to experiment without big deposits.

- Watch out for: Spreads are average, and withdrawal terms can vary by promotion.

4. Octa – Best for Mobile-First Traders

- Why choose it: Clean app interface, low deposit requirements, and regular Thai-market promotions.

- Who it’s for: Younger traders or those who prefer to trade primarily on mobile.

- Watch out for: Customer service response times and slightly higher-than-average spreads.

5. eToro – Built Around Social and Copy Trading

- Why choose it: Allows you to copy strategies from other top-performing traders. Includes a community and educational content.

- Who it’s for: Beginners who want to learn through observing and following others.

- Watch out for: Higher spreads and fewer Thai-specific features.

Step 4: Try a Demo or Start Small

Once you’ve narrowed down your choices, test the waters. Most of the platforms above offer demo accounts or low minimum deposits.

Tips:

- Use a demo account to try out the interface and features

- Don’t chase promotions unless you understand the fine print

- Test withdrawal speed and customer service early, not after a problem arises

Step 5: Stay Safe and Keep Learning

Even the best platform won’t protect you from poor trading habits. No matter which broker you choose:

- Verify regulation status before depositing

- Avoid high leverage if you’re still learning

- Keep track of fees—especially spreads and withdrawal charges

- Keep learning through articles, videos, or the broker’s own educational tools

Final Thoughts: There’s No “One Size Fits All”

The truth is, there’s no single “best” Forex trading platform for everyone in Thailand. It all comes down to your style, budget, and goals.

If you want local support and convenience, Exness is a great place to start. If you’re chasing low spreads, IC Markets or XM may fit the bill. For a more modern mobile experience, look into Octa. And if you want to learn from others, eToro offers a more social way to trade.

Choosing your platform is the first decision—trading smart is the next.