In Singapore, conversations around Ethereum vs Bitcoin Singapore rarely stay superficial for long. Scroll past the charts, ignore the Twitter hype, and you’ll hear a more grounded discussion: not just price, but purpose—and how blockchain fits into national infrastructure, ESG targets, and regulatory frameworks.

That’s especially true when you talk about Ethereum vs Bitcoin Singapore in 2025. Here, it’s less about which coin pumped this week and more about which one fits the system being built. And increasingly, that coin is Ethereum.

Let’s walk through the real questions people are asking—and what the answers tell us.

1. Why is Ethereum outperforming Bitcoin in Singapore’s current market?

Created By cryptobriefing

The short version? Ethereum gets used. A lot.

Not just by traders or DeFi nerds, but by people building actual tools—finance prototypes, ESG reporting dashboards, tokenized bonds. And that matters here. Singapore doesn’t just tolerate innovation; it expects it to plug into policy.

Bitcoin, while powerful, isn’t programmable in the same way. It does one thing extremely well: store value. But that’s not enough when regulators are testing pilot projects and asking chains to do more than secure a ledger.

2. What are people doing with Ethereum smart contracts in Singapore?

Created By carret

It’s not about crypto collectibles anymore. Instead, Ethereum smart contracts in Singapore are showing up in legal tech, tokenized real estate trials, and even carbon credit pilots.

Take real estate tokens, for instance. These now often come with embedded compliance rules. As a result, contracts can enforce who is eligible to buy, how many units are permitted per wallet, and even include anti-money laundering checks baked right into the code. By comparison, trying to implement this on Bitcoin’s chain would be a stretch.

This functional difference is exactly why Ethereum is becoming the chain of choice—not just for developers, but for institutions looking to integrate blockchain into policy-aligned use cases.

3. What does MAS Project Guardian have to do with Ethereum vs Bitcoin Singapore?

Created By cryptodispensers

Quite a bit, actually.

MAS Project Guardian is Singapore’s controlled environment for testing what tokenized finance could look like under regulation. Most of what’s being built or tested here? It runs on Ethereum-compatible platforms.

That’s because Ethereum allows more flexibility—you can program access, compliance, timing, conditions. Bitcoin’s network simply wasn’t built for that kind of logic.

So in this context, Ethereum vs Bitcoin Singapore isn’t just a coin flip. It’s a policy match-up. And Ethereum wins that round.

4. Didn’t Ethereum switch to proof-of-stake years ago? Why does that still matter in 2025?

Yes, The Merge happened in 2022. But its ripple effects are still playing out.

Singapore takes ESG seriously. Reporting on environmental impact isn’t optional for many firms. That means if a blockchain guzzles energy, it’s a tough sell—especially for institutional players.

Ethereum’s switch to proof-of-stake massively cut its energy use. That one move made it possible for banks and ESG funds to finally consider using it without PR risk. Bitcoin? Still proof-of-work. Still an issue in boardrooms.

5. Why is tokenization in Singapore mostly happening on Ethereum?

Tokenization in Singapore is real. And it’s not about coins—it’s about infrastructure: green bonds, securities, stable real-world assets.

Ethereum is winning this space not because it’s trendy, but because it has standards developers know and auditors trust. ERC protocols like ERC-1400 let issuers define roles, permissions, and restrictions in a way that aligns with policy.

If you’re a lawyer, a banker, or a regulator? That predictability matters.

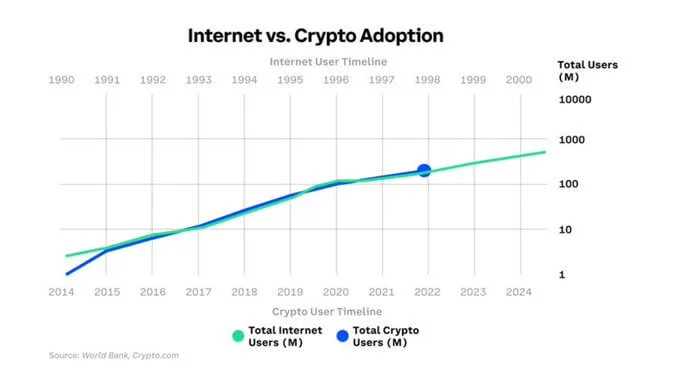

6. How does crypto adoption in Singapore reflect Ethereum vs Bitcoin Singapore?

Created By cryptoslate

Everyday users don’t always name Ethereum. But they’re using it. The dApps are there. The wallets work. The tools are live.

Crypto adoption in Singapore is practical. People stake ETH, use Layer 2 apps, trade stablecoins, mint tokenized assets. Bitcoin? Still widely respected—but mostly as digital gold.

So when you track behavior, not headlines, it’s clear: Ethereum vs Bitcoin Singapore isn’t about ideology. It’s about activity.