What If Day Trading Could Make You Rich — But Break You First?

Day trading risks are not new. But the sheer popularity of this high-frequency, high-pressure trading style has made it a cultural touchpoint among aspiring investors — especially in Vietnam’s growing retail market.

And the question that quietly sits behind every flickering chart and fast decision: what if this trade could make me rich?

The more accurate follow-up: what if it doesn’t?

Let’s explore this paradox — where the thrill of quick gains keeps people hooked, even when the odds are stacked against them.

The Core of the Craze: What Is Day Trading?

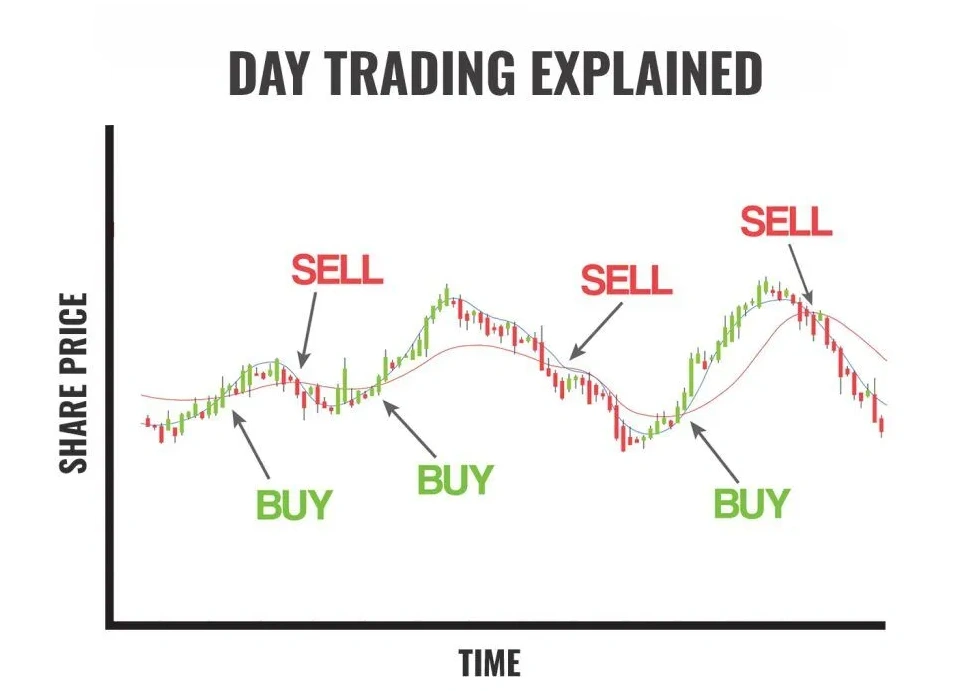

Credit from EBC Financial Group

At its heart, day trading is about opening and closing trades within a single day. No holding overnight, no waiting for long-term market trends. Every decision — whether it’s buying a Vietnamese stock, scalping a currency pair, or reacting to a news spike — happens in real-time.

The goal? Capitalize on small price movements using quick entries and exits.

It sounds simple. But as anyone who’s tried knows, the execution requires razor-sharp discipline, rapid analysis, and emotional stamina. One missed signal or poorly timed trade can flip a potential gain into a costly loss — in minutes.

This is especially true in high-frequency trading, where dozens — or even hundreds — of trades are executed in a single day.

Day Trading Risks: Why Day Trading Feels So Attractive

So why day trading, if the risk is so steep?

For starters, it gives investors full control. You’re not at the mercy of quarterly earnings, geopolitical risk, or long-term volatility. You can — at least theoretically — start the day flat and finish with profit.

In Vietnam, where access to digital platforms and mobile apps has expanded dramatically, day trading popularity has exploded in recent years. Local traders now participate actively in markets like VN30F futures, forex pairs, and derivatives.

Even with day trading in Vietnam limited by the T+2 settlement rule for stocks, alternatives like contracts-for-difference (CFDs) and intraday index futures provide the velocity that day traders crave.

What makes this model so seductive?

- Fast feedback loops — trades resolve quickly

- No overnight exposure — reduced risk of after-hours shocks

- Tech-powered access — instant trades, global news, and mobile alerts

- A cultural shift — financial success is being redefined through screens

The Hidden Dangers: Why Day Trading Is Risky

Still, behind every success story is often a silent graveyard of failed trades.

Market and Price Volatility

Market movements are rarely smooth. Sudden breakouts, flash crashes, and fakeouts can wipe out capital faster than any chart can refresh.

Even when you have a strong thesis — say, a bullish reversal on the VNIndex — a minor news item or unexpected foreign sell-off can derail the setup instantly.

Psychological Fatigue

Constant decision-making wears traders down. It’s not uncommon for beginners to place revenge trades after a loss or abandon strategies mid-session because of emotion.

One Vietnamese trader recalled accidentally placing a 10x larger position than intended due to a split-second lapse in concentration.

Tech Trouble

Fast markets require fast tools. But that doesn’t guarantee perfection. From internet outages to overloaded exchanges (remember HOSE’s 2021 congestion?) — technological risks are real, especially when timing is everything.

Margin and Leverage

Many traders operate with borrowed capital. In theory, this boosts gains. In practice, it magnifies losses. A 5% move against you on 5x leverage? That’s 25% gone from your account.

Real-Life Complications: Day Trading in Vietnam

Day trading in Vietnam comes with its own set of quirks:

- T+2 rule: You can’t technically buy and sell the same stock on the same day unless you’re trading derivatives or CFDs.

- Low liquidity in certain stocks leads to big bid-ask spreads (e.g., WCS vs. FLC).

- Limited short-selling options make hedging strategies harder.

And while local traders have adapted — often turning to VN30F futures or FX — these instruments come with their own steep learning curves.

Day Trading Risks: Why It’s Still Popular (Even Among Beginners)

Credit from Fidelity Investments

Despite all this, the method persists — and grows.

There’s an undeniable dopamine hit when a trade goes right. There’s also the community — thousands of Vietnamese traders sharing charts, setups, and (occasionally) memes across Telegram, TikTok, and forums.

Is day trading safe? Not exactly. But it is active, engaging, and — for some — an accessible way to feel connected to the market.

This human element can’t be overstated. For many, day trading isn’t just about money — it’s about movement, purpose, and the chance to beat the system, even for a moment.

Managing the Madness: How Smart Traders Handle the Day Trading Risks

Experienced traders know that success comes not from winning every trade, but from limiting the damage when they lose.

Here’s how they survive — and sometimes thrive:

- Position sizing rules: Never risk more than 1–2% of total capital per trade

- Hard stop losses: Set them before entry, and don’t move them out of hope

- R:R ratios: Target 1:2 or 1:3 setups to stay profitable over time

- Daily max loss: Walk away after three losses or hitting a loss cap

- No signal = no trade: Avoid setups that don’t fully align with your system

Tools like MetaTrader, TradingView, and cTrader make it easier to build and execute such risk frameworks. But the real key is emotional control — and accepting that sitting out is sometimes the most profitable move.

The Bigger Picture: Is It Worth It?

Day trading isn’t for everyone. It demands time, precision, and a willingness to endure both wins and wipeouts.

Yet, for a growing number of Vietnamese investors, it offers a window into modern finance — a way to engage with the market without waiting years to see results.

Some will burn out. Others will adapt, grow, and evolve their strategies. A few may even go on to build sustainable careers in short-term trading.

But no matter the outcome, the day trading risks should never be underestimated — nor should the reasons why people keep coming back.

Final Thoughts on Day Trading Risks

Day trading risks are woven into the very structure of this trading style — fast, unforgiving, and emotionally intense. But as platforms become more accessible and financial literacy rises, it’s not surprising that high-frequency trading is gaining popularity, even among risk-conscious Vietnamese investors.

For beginners, the key lies not in chasing every candle, but in building the emotional and technical resilience to navigate the chaos.

Sometimes, the best trade is not placing one at all.