Introduction: The Role of BI Forex Intervention in 2025

In 2025, with currency markets more sensitive than ever to global shifts, Indonesia relies on BI forex intervention to help maintain financial stability. As central banks around the world adjust interest rates and capital flows fluctuate rapidly, Bank Indonesia plays a key behind-the-scenes role in keeping the rupiah from swinging too wildly. This tutorial offers a practical breakdown of how and why BI intervenes in the forex market—and what it means for the economy and everyday life.

Step 1: What Does BI Forex Intervention Actually Mean?

Source: TradingEconomics

BI forex intervention refers to Bank Indonesia’s actions in the foreign exchange (forex) market to reduce excessive fluctuations in the rupiah’s exchange rate. This isn’t about setting the currency to a fixed value—it’s about ensuring price movements remain orderly. In 2025, BI’s interventions have continued to help limit the damage of global shocks like sudden capital outflows or commodity price spikes, ensuring the currency remains broadly aligned with economic fundamentals.

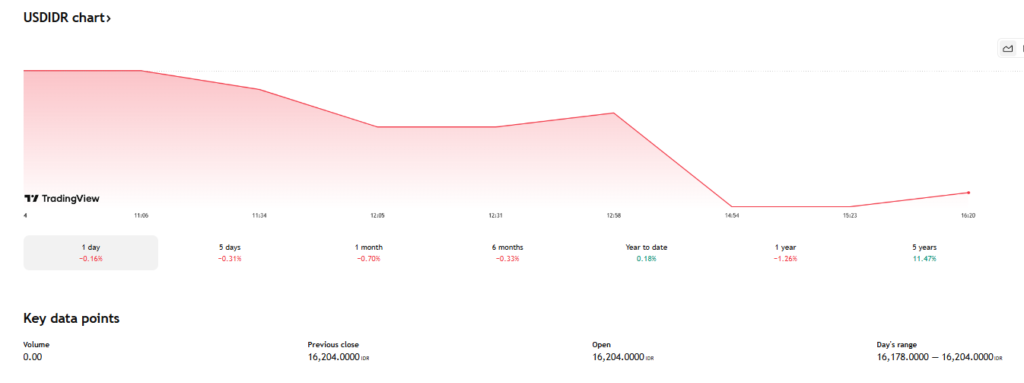

Step 2: Why Is Intervention Still Necessary in 2025?

Source: TradingView

Despite moving toward more open markets, Indonesia’s economy remains vulnerable to external volatility. Currency fluctuations can drive up inflation, hurt businesses with foreign exposure, and spook investors. With 2025 bringing persistent uncertainty—ranging from global rate hikes to commodity supply issues—Bank Indonesia continues to use intervention as a stabilizing force. It serves as a buffer, allowing time for broader policy measures to take effect while protecting economic momentum.

Step 3: What Tools Does Bank Indonesia Use for Forex Intervention?

In 2025, Bank Indonesia employs a mix of direct and indirect instruments to influence the forex market:

- Spot Market Operations: BI buys or sells U.S. dollars to adjust supply and demand pressures in real time.

- Domestic Non-Deliverable Forwards (DNDFs): These contracts allow market players to hedge against future currency risk, smoothing expectations.

- FX Reserves: BI uses its foreign reserves as a cushion to supply the market with liquidity during periods of stress.

- Monetary Policy Coordination: Interest rate adjustments and macroprudential tools also help support the currency indirectly.

These methods are carefully calibrated, especially in 2025, when sentiment can shift dramatically in response to global headlines.

Step 4: When Does BI Intervene in the Market?

BI does not intervene constantly, nor does it aim to halt all movement in the rupiah. Instead, intervention typically occurs when the currency weakens or strengthens too quickly in ways not justified by Indonesia’s economic performance. For instance, in early 2025, a surge in U.S. Treasury yields triggered outflows from emerging markets. BI responded quietly by selling dollars and offering DNDFs to limit the rupiah’s slide—calming markets without sending panic signals.

Step 5: How Does Forex Intervention Help the Economy?

Source: BROOKINGS

By reducing short-term exchange rate volatility, BI intervention supports multiple layers of the economy. It helps anchor inflation expectations, encourages investment stability, and gives importers/exporters a more predictable pricing environment. In 2025, the effectiveness of intervention has been evident in the steady performance of the rupiah relative to regional peers, even amid ongoing global financial turbulence.

Step 6: Is BI Transparent About Its Currency Actions?

Source: Reuters

Bank Indonesia walks a fine line in terms of communication. While it regularly communicates its broader goals and foreign exchange principles, it does not disclose every market move. This partial transparency is strategic. In 2025, too much detail could invite speculative behavior or trigger market overreactions. BI instead provides insight through quarterly monetary statements, economic outlook briefings, and data on FX reserves—giving markets guidance without revealing its hand.

Step 7: What Does This Mean for Everyday Indonesians in 2025?

Source: Tempo

Though the mechanics of forex policy may feel far removed from daily life, the impact is real. A stable rupiah protects against higher costs for fuel, imported food, and foreign-made consumer goods. It also creates a stable backdrop for job creation, investment, and long-term planning. In 2025, BI forex intervention continues to act as a silent but powerful mechanism that keeps inflation in check and household spending more predictable.

Conclusion: BI Forex Intervention in 2025—Still Essential, Still Evolving

As financial conditions evolve, so does the role of BI forex intervention. In 2025, Bank Indonesia’s measured, market-sensitive strategy remains vital for shielding the rupiah from external pressures. Through its layered approach—spot market activity, DNDFs, and prudent communication—BI helps preserve Indonesia’s macroeconomic balance. For analysts, investors, and the public alike, understanding how BI manages the currency is key to understanding the rhythm of the nation’s economy.